Global Nanosatellite And Microsatellite Market Overview

Nanosatellite and Microsatellite Market size was valued at about USD 2.4 Billion in 2024 and expected to grow at CAGR of 18.10% to extend a value of USD 12.7 Billion by 2034.

A satellite is an object or equipment which is sent to space that moves around the planet to collect the information. Mostly, the nanosatellite and microsatellite are used for space research, communication purposes, and earth observation. The application of nanosatellites and microsatellites is seen in the defense sector, military, and also for commercial purpose. These satellites are smaller in size, cost-effective than larger satellites. Nanosatellite is any satellite weighing less than 10 kg. Microsatellite is usually name of an artificial satellite with a mass range between 10 and 100 kg.

Disclaimer: This data is only a representation. Actual data may vary and will be available in the report.

Global Nanosatellite And Microsatellite Market Dynamics

Rising demand of LEO-based services

The demand for LEO-based services, high-speed broadband, accessibility of funding, growth of governments in industrialized countries, and the necessity for low-cost broadband among individual consumers in less developed countries are influencing the growth of the nanosatellites and microsatellites market. Earth observation services widely cover the detection of climatic changes, monitoring of agricultural fields, disaster mitigation, meteorology, and numerous other resources. The necessity of high-resolution Earth imaging has raised for precise management of water, land, and forest resources. Further, to study the impact of COVID-19 on air quality and atmosphere, the agencies are focusing on the active use of satellite imagery. The application of space-based inputs is evidencing extreme use for disaster forewarning as well as post-disaster management.

Conversely, the government regulatory challenges for increasing number of satellites being launched is expected to limit the growth of the target market over the forecast period.

Global Nanosatellite And Microsatellite Market Segmentation

The nanosatellite and microsatellite market is segmented based on component, mass, application, vertical, and region.

On the basis of the component, the nanosatellite and microsatellite market is segmented into hardware, software, data processing, and launch services. Based on the mass, the target market is segmented into 1 Kg – 10 Kg (Nanosatellites) and 11 Kg – 100 Kg (Microsatellites). Based on the application, the target market is classified into communication, reconnaissance, navigation and mapping, scientific research, and others. Based on the vertical, the target market is classified into government, civil, commercial, defense, energy and infrastructure, and maritime and transportation.

Regional Insights:

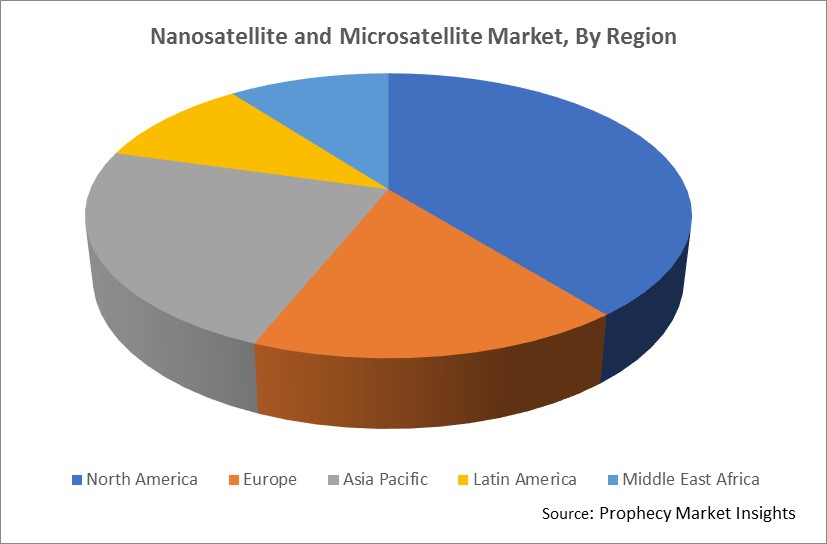

Nanosatellite and microsatellite market accounted for US$ 1.5 billion in 2020 and is estimated to be US$ 12.15 billion by 2030 and is anticipated to register a CAGR of 23.5%. On region the nanosatellite and microsatellite market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. North America leads the global market with a maximum revenue share in 2019, due to the rising investments in space-related activities. For example, NASA assigns a precise budget for space-related activities every year including science, space technology, aeronautics, exploration, and other space operations. Additionally, growth in the regional demand for small satellites from diverse end-use segments such as military and defense, research organizations, and telecommunications has offered impulse growth opportunities for the regional market. The Asia Pacific is expected to grow as the fastest-developing regional market as economies in the region, such as India and Japan, continue to violently launch small satellites for communication and navigation purposes.

Report Scope:

|

Attribute |

Details |

|

Market Size 2024 |

US$ 2.4 billion |

|

Projected Market Size 2034 |

US$ 12.7 billion |

|

CAGR Growth Rate |

18.10% |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 – 2034 |

|

Market representation |

Revenue in USD Billion & CAGR from 2024 to 2034 |

|

Market Segmentation |

By Component - Hardware, Software, Data Processing, and Launch Services By Mass - 1 Kg – 10 Kg (Nanosatellites) and 11 Kg – 100 Kg (Microsatellites) By Application - Communication, Reconnaissance, Navigation and Mapping, Scientific Research, and Others By Vertical - Government, Civil, Commercial, Defense, Energy and Infrastructure, and Maritime and Transportation |

|

Regional scope |

North America - U.S., Canada Europe - UK, Germany, Spain, France, Italy, Russia, Rest of Europe Asia Pacific - Japan, India, China, South Korea, Australia, Rest of Asia-Pacific Latin America - Brazil, Mexico, Argentina, Rest of Latin America Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

Segments Covered in the Report:

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2020 to 2030. For the purpose of this study, has segmented the nanosatellite and microsatellite market report based on component, mass, application, vertical, and region.

Nanosatellite and Microsatellite Market, By Region:

- North America

- Middle East & Africa

-

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

-

- Latin America

-

- Brazil

- Mexico

- Rest of Latin America

-

- Asia Pacific

-

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

-

- Europe

-

- Germany

- UK

- France

- Russia

- Italy

- Rest of Europe

-

-

- U.S.

- Canada

- Middle East & Africa

Global Nanosatellite And Microsatellite Market Key Players

The key players operating in the nanosatellite and microsatellite market includes Lockheed Martin Corporation, Raytheon, Clyde Space, Inc., Sierra Nevada Corporation, RUAG Group, Planet Labs, Inc., Innovative Solutions in Space (ISIS) Group, GomSpace, Skybox Imaging, Inc., and Space Quest Ltd.

GomSpace:

They have signed an expansion contract with the European Space Agency (ESA) for starting a new GOMX-5 satellite mission. The aim of the mission is to identify new nanosatellite capabilities.

Global Nanosatellite And Microsatellite Market Company Profile

- Lockheed Martin Corporation

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Raytheon

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Clyde Space, Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Sierra Nevada Corporation

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- RUAG Group

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Planet Labs, Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Hardy Diagnostics

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Innovative Solutions In Space (ISIS) Group

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- GomSpace

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Skybox Imaging, Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- SpaceQuest Ltd.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

Global Nanosatellite And Microsatellite Market Table of Contents

- Research Objective and Assumption

- Preface

- Research Objectives

- Study Scope

- Years Considered for the study

- Assumptions

- Abbreviations

- Research Methodology

- Research data

- Primary Data

- Primary Interviews

- Primary Breakdown

- Key data from Primary Sources

- Key Thickness Insights

- Secondary Data

- Major Secondary Sources

- Secondary Sources

- Market Estimation

- Top-Down Approach

- Approach for estimating Market Share by Top-Down Analysis (Supply Side)

- Bottom-Up Approach

- Approach for estimating market share by Bottom-up Analysis (Demand Side)

- Market Breakdown and Data Triangulation

- Research Assumptions

- Market Preview

- Executive Summary

- Key Findings—Global Outlook for Nanosatellite and Microsatellite Strategies

- Key Questions this Study will Answer

- Market Snippet, By Component

- Market Snippet, By Mass

- Market Snippet, By Application

- Market Snippet, By Vertical

- Market Snippet, By Region

- Opportunity Map Analysis

- Executive Summary—3 Big Predictions

- Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restraints

- Market Opportunities

- Market Trends

- DR Impact Analysis

- PEST Analysis

- Porter’s Five Forces Analysis

- Opportunity Orbit

- Market Investment Feasibility Index

- Macroeconomic Factor Analysis

- Market Dynamics

- Market Segmentation, By Component, 2024 – 2034, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), 2024 – 2034

- Y-o-Y Growth Analysis (%), 2024 – 2034

- Segment Trends

- Hardware

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Software

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Data Processing

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Launch Services

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Overview

- Market Segmentation, By Mass, 2024 – 2034, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), 2024 – 2034

- Y-o-Y Growth Analysis (%), 2024 – 2034

- Segment Trends

- 1 Kg – 10 Kg (Nanosatellites)

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- 11 Kg – 100 Kg (Microsatellites)

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Overview

- Market Segmentation, By Application, 2024 – 2034, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), 2024 – 2034

- Y-o-Y Growth Analysis (%), 2024 – 2034

- Segment Trends

- Communication

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Reconnaissance

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Navigation and Mapping

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Scientific Research

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Others

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Overview

- Market Segmentation, By Vertical, 2024 – 2034, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), 2024 – 2034

- Y-o-Y Growth Analysis (%), 2024 – 2034

- Segment Trends

- Government

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Civil

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Commercial

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Defense

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Energy and Infrastructure

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Maritime and Transportation

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), 2024 – 2034

- Overview

- Global Market, By Region, 2024 – 2034, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), 2024 – 2034

- Y-o-Y Growth Analysis (%), 2024 – 2034

- Regional Trends

- North America

- Market Size and Forecast (US$ Bn), By Component, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Mass, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Application, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Vertical, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Country, 2024 – 2034

- U.S.

- Canada

- Europe

- Market Size and Forecast (US$ Bn), By Component, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Mass, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Application, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Vertical, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Country, 2024 – 2034

- Germany

- UK

- France

- Russia

- Italy

- Rest of Europe

- Asia Pacific

- Market Size and Forecast (US$ Bn), By Component, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Mass, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Application, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Vertical, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Country, 2024 – 2034

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America

- Market Size and Forecast (US$ Bn), By Component, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Mass, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Application, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Vertical, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Country, 2024 – 2034

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- Market Size and Forecast (US$ Bn), By Component, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Mass, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Application, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Vertical, 2024 – 2034

- Market Size and Forecast (US$ Bn), By Country, 2024 – 2034

- GCC

- Israel

- South Africa

- Rest of Middle East

- Overview

- Competitive Landscape

- Heat Map Analysis

- Market Presence and Specificity Analysis

- Company Profiles

- Lockheed Martin Corporation

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Raytheon

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Clyde Space, Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Sierra Nevada Corporation

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- RUAG Group

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Planet Labs, Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Innovative Solutions In Space (ISIS) Group

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- GomSpace

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Skybox Imaging, Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- SpaceQuest Ltd.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Overview

- Business Strategies

- Lockheed Martin Corporation

- The Last Word

- Future Impact

- About Us

- Contact

FAQs

Nanosatellite and microsatellite market IS segmented based on component, mass, application, vertical, and region.

Growing LEO-based services demand is likely to drive the growth of the Nanosatellite and Microsatellite market over the forecast period.

North America leads the global market with a maximum revenue share in 2019, due to the rising investments in space-related activities.

The rising number of mergers and acquisitions and collaborations is estimated to impel the global market in the upcoming years.