Global Commercial Aircraft Wet Lease Overview

Global commercial aircraft wet lease ACMI market report published by Prophecy Market Insights offers holistic view of various influencing factors and aims to answer all the target market related questions.

Faster leasing and low cost of capital investment are factors to spike up growth of the global commercial aircraft wet lease ACMI market. Leasing aircraft supports operating of aircraft without any economic burden, as purchasing of airplanes and other resources associated with it takes heavy cost over leasing of aircraft. Increasing numbers of mergers and acquisitions among the key operating players of the target market are expected to fuel growth of the global market which has a profound impact on regional aviation landscape. For instance, In August 2018 Danish Air Transport (DAT) bought a majority shareholding i.e. 60 percent of Nordic Regional Airlines (Norra) from Finnair, which retains the other 40 percent. This kind of tie-ups is likely, with combinations designed to give added strength to ACMI providers. However, high cost is associated with the wet lease as providers need to make a return and also need to cover the cost of idle period, which is a major factor restraining growth of the target market.

Prophecy Market Insights provides detailed analysis on the target market. The report covers market analysis - by type, application, and region. The report provides market size (US$ Mn) and compounded annual growth rate (%) for the forecast period: 2019 – 2029, considering 2018 as the actual year. This report contains detailed analysis about drivers, restraints, opportunities, ongoing trends, customer demand, product launches, and region analysis for the target market. In addition, the report delivers competitive analysis regarding key players in the global commercial aircraft wet lease ACMI market based on various parameters including company overview, product portfolio, market presence, financial performance, key developments, and future strategies.

Report analysis would support management authorities as well as marketers of the companies to make right decision for building business strategies, market expansion, product launches, understanding demand and supply. Significant strategy matrices include but not limited to in the report are PEST analysis, PORTER’s five forces analysis, driver and restraint impact analysis, market opportunity analysis, and market specificity analysis.

Global Commercial Aircraft Wet Lease Segmentation

Global Commercial aircraft wet lease ACMI Market Segmentation:

-By Body Type:

- Narrow

- Airbus

- Boeing

- Wide

- Airbus

- Boeing

-By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Key players operating in the global commercial aircraft wet lease ACMI market include, Titan Airways, AVION EXPRESS, SMART LYNX, OLYMPUS, JUST US, GOWAIR, WAMOS, HIFLY, PLUS ULTRA, GETJET, and EUROATLANTIC

Chapters covered in this report are:

Chapter 1: Table of Contents

Chapter 2: Market Purview

Chapter 3: Market Dynamics

Chapter 4: Global Commercial aircraft wet lease ACMI Market Analysis, By Type

Chapter 5: Global Commercial aircraft wet lease ACMI Market Analysis, By Application

Chapter 6: Global Commercial aircraft wet lease ACMI Market Analysis, By Region

Chapter 7: Competitive Landscape

Chapter 8: Company Profiles

Chapter 9: Research Methodology

Customized Research:

Prophecy Market Insights is able to provide customized research reports as per the specific business requirements.

Global Commercial Aircraft Wet Lease Table of Contents

- Research Objective and Assumption

- Preface

- Research Objectives

- Study Scope

- Years Considered for the study

- Assumptions

- Abbreviations

- Research Methodology

- Research data

- Primary Data

- Primary Interviews

- Primary Breakdown

- Key data from Primary Sources

- Key Thickness Insights

- Secondary Data

- Major Secondary Sources

- Secondary Sources

- Market Estimation

- Top-Down Approach

- Approach for estimating Market Share by Top-Down Analysis (Supply Side)

- Bottom-Up Approach

- Approach for estimating market share by Bottom-up Analysis (Demand Side)

- Market Breakdown and Data Triangulation

- Research Assumptions

- Market Preview

- Executive Summary

- Key Findings—Global Outlook for medical carts Strategies

- Key Questions this Study will Answer

- Market Snippet, By Body Type

- Market Snippet, By Region

- Opportunity Map Analysis

- Executive Summary—3 Big Predictions

- Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restrains

- Market Opportunities

- Market Trends

- DR Impact Analysis

- PEST Analysis

- Porter’s Five Forces Analysis

- Opportunity Orbit

- Market Investment Feasibility Index

- Macroeconomic Factor Analysis

- Market Dynamics

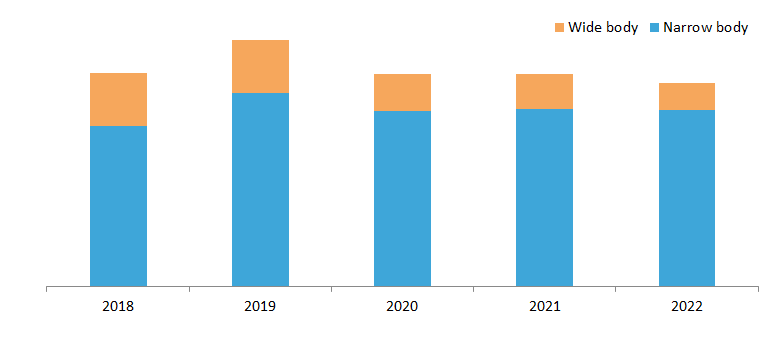

- Commercial Aircraft Wet Lease ACMI Market, By Body Type, Forecast Period up to 10 Years, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), Forecast Period up to 10 Years

- Y-o-Y Growth Analysis (%), Forecast Period up to 10 Years

- Segment Trends

- Narrow (AirBus and Boeing)

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Wide (Airbus and Boeing)

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Commercial Aircraft Wet Lease ACMI Market, By Region, Forecast Period up to 10 Years, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), Forecast Period up to 10 Years

- Y-o-Y Growth Analysis (%), Forecast Period up to 10 Years

- Regional Trends

- North America

- Market Size and Forecast (US$ Bn), By Body Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- U.S.

- Canada

- Europe

- Market Size and Forecast (US$ Bn), By Body Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- UK

- France

- Germany

- Russia

- Italy

- Rest of Europe

- Asia Pacific

- Market Size and Forecast (US$ Bn), By Body Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- India

- Japan

- South Korea

- China

- Rest of Asia Pacific

- Latin America

- Market Size and Forecast (US$ Bn), By Body Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- Market Size and Forecast (US$ Bn), By Body Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- GCC

- Israel

- South Africa

- Rest of Middle East

- Overview

- Competitive Landscape

- Heat Map Analysis

- Market Presence and Specificity Analysis

- Company Profiles

- Titan Airways

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- AVION EXPRESS

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- SMART LYNX

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- OLYMPUS

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- JUST US

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- GOWAIR

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- WAMOS

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- HIFLY

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- PLUS ULTRA

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- GETJET

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- EUROATLANTIC

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- The Last Word

- Future Impact

- About Us

- Contact

FAQs

The commercial aircraft wet lease ACMI market accounted for US$ 7353.1 million in 2019 and is projected to register a moderate CAGR of 4.1% over the forecast period.

The market report has been segmented on the basis of body type and region.

Increase in short-term aircraft lease agreements, the demand for flexible and scalable capacity solutions by airlines, and a focus on cost-effective alternatives for fleet management. Opportunities could arise from the dynamic nature of airline operations, market demand for additional capacity, and collaborations for optimizing fleet utilization through wet leasing.

The volatility in airline demand, the desire for fleet flexibility without long-term commitments, and the need for airlines to address capacity shortfalls or operational disruptions. Additionally, factors such as cost considerations, seasonal demand fluctuations, and the ability to access specialized aircraft for specific routes or market conditions contribute to the market dynamics.

Regions typically considered include North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. The dominance of the market may depend on factors such as the concentration of airlines, the level of air travel demand, and regulatory conditions regarding wet leasing.

The prominent player operating in the global commercial aircraft wet lease ACMI market includes Boeing Co., SMBC Aviation Capital, Ltd., Air Lease Corporation, AerCap Holding NV, BBAM LLC, BOC Aviation Ltd., Nordic Aviation Capital, Aviation Capital Group LLC, Avolon Holding Ltd., Titan Airways, AVION EXPRESS, SMART LYNX, OLYMPUS, JUST US, GOWAIR, WAMOS, HIFLY, PLUS ULTRA, GETJET, and EUROATLANTIC