Global Alcoholic ReadyToDrink RTDsHigh Strength Overview

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market was valued at US$ 35.6 billion in 2024 and is projected to grow at a CAGR of 4.3% to reach US$ 54.2 billion by 2034.

Alcoholic Ready-To-Drink (RTDs) or High Strength Premixes are beverages that come pre-mixed and ready to consume without the need for additional ingredients or preparation. These beverages typically contain a combination of alcohol, mixers, and flavorings, offering a convenient and portable option for individuals looking for a quick and easy way to enjoy a cocktail or mixed drink. One of the main advantages of RTDs is their convenience. They eliminate the need for consumers to purchase multiple ingredients, measure quantities, and mix drinks themselves. This convenience makes them popular for on-the-go situations, outdoor events, and casual gatherings.

RTDs come in a wide range of flavors, catering to different taste preferences. Popular options include classic cocktails like Margaritas, Mojitos, and Moscow Mules, as well as unique and innovative flavor combinations. Since these drinks are pre-mixed by manufacturers, consumers can expect a consistent taste and quality with each purchase. This consistency can be appealing to those who want a reliable and familiar beverage experience.

Disclaimer: This data is only a representation. Actual data may vary and will be available in the report.

Global Alcoholic ReadyToDrink RTDsHigh Strength Dynamics

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market Key Drivers:

- Convenience and Portability

Alcoholic Ready-To-Drink (RTDs) save customers the trouble of gathering various components, calculating serving sizes, and combining drinks by hand. This feature that saves time is appealing to people with hectic schedules who are looking for easy ways to meet people or have a drink without having to make a big meal. Cans, bottles, and pouches are common portable container types used to package RTDs. Customers' portability is made easier by the packaging's thoughtful design, which is lightweight, easy to carry, and practical.

Alcoholic Ready-To-Drink (RTD) products are ideally suited for outdoor gatherings and activities due to their portability. Without bulky bottles or mixing equipment, customers may enjoy their favorite cocktails at the beach, picnics, barbecues, or camping excursions. RTDs' portability makes sharing and consuming them simple in social situations where people may walk around or socialize. Because of its small size, the packaging makes drinking more communal and encourages a sense of community and shared experiences.

- Changing Consumer Preferences

Changing consumer preferences play a pivotal role in shaping the dynamics of the Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes market. Several factors influence these preferences, reflecting evolving tastes, lifestyle choices, and cultural shifts. Consumers are increasingly drawn to innovative and unique flavor profiles. While classic cocktails remain popular, there is a growing demand for novel combinations and exotic flavors.

- Rise in Outdoor and Social Activities

The market for alcoholic ready-to-drink (RTDs) and high-strength premixes has been greatly impacted by the increase of outdoor and social activities, which has also shaped customer tastes. Customers participate in a range of outdoor events, including camping, festivals, beach vacations, picnics, and barbecues. People frequently move around and engage with one another at social gatherings.

- Innovation and Product Development

Innovation and product development play crucial roles in driving growth and maintaining competitiveness in the Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes market. The industry is dynamic, with companies continually introducing new products, flavors, and packaging to meet changing consumer preferences. Companies focus on creating a wide variety of flavors to cater to diverse consumer preferences. For example, Unique and exotic flavor combinations, seasonal releases, and collaborations with mixologists contribute to a diverse flavor landscape.

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market Restrains:

- Regulatory Compliance and Licensing

The alcoholic beverage industry is subject to strict regulations, including licensing, labeling, and advertising restrictions. Compliance with these regulations poses challenges and impact the market entry of new products.

- Health and Wellness Concerns

Increasing awareness of health and wellness may lead some consumers to opt for non-alcoholic or lower-alcohol alternatives. Concerns about the calorie content and potential health effects of high-strength alcoholic beverages limits market growth.

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market Key Opportunities:

- Further expansion of diverse and unique flavor profiles to cater to evolving consumer tastes.

- Continued focus on premium and craft offerings to appeal to consumers willing to pay for high-quality and sophisticated drinks.

- Ongoing innovation in packaging design, including sustainability-focused initiatives, to enhance the visual appeal and environmental friendliness of products.

- Exploring innovative blends that cross traditional beverage categories, offering unique hybrid products.

Recent Development:

- In March 2023, the pre-mixed, canned cocktail Jack Daniel's & Coca-Cola RTD, which debuted in Mexico, has also launched in US supermarkets. As consumers have appreciated the combination of these two iconic brands for years, this introduction in the United States marks a significant milestone for both Coca-Cola and Jack Daniel's. It also exemplifies our dedication to innovation, from the basic to the complicated.

- In December 2023, Incredible Spirits Private Limited (ISPL), an Indian alcohol beverage start-up, has launched India’s first premium spirits-based Ready-to-Drink (RTD) shots, under the brand name SWIGGER. Initially, this finely produced product in two gin and two vodka varieties has been released, blending natural and organic aromas. The vodka-based drinks have been distilled with Mandarin and Lime, Lychee, and Cinnamon, while the gin-based shots have been made with Elderflower and Berries, Pink Grapefruit, and Lime. These tasty shots are now available in 60 ml double shot glasses with a pull-rip cap closing, guaranteeing customers a convenient, safe, and unadulterated experience.

- In December 2023, Coca-Cola India has been reportedly working on entering the alcoholic beverage segment in the country with the introduction of Lemon-Dou, a global alcoholic ready-to-drink beverage. According to Economic times, the company has conducted pilot tests for Lemon-Dou in selected regions such as Goa and other parts of Maharashtra.

Global Alcoholic ReadyToDrink RTDsHigh Strength Segmentation

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market is segmented based on Product Type, Application, and region.

Product Type Insight

- Spirit-based RTDs: Spirit-based RTDs are ready-to-drink beverages that incorporate distilled spirits as their primary alcoholic component. These beverages often mimic popular cocktails or traditional mixed drinks and come in pre-mixed and pre-measured formats.

- Wine-based RTDs: Wine-based RTDs are ready-to-drink beverages where wine serves as the alcoholic base. These products often blend wine with other ingredients to create refreshing and flavorful options, making them an alternative to traditional bottled wines.

- Malt-based RTDs: Malt-based RTDs use malt beverages, which are fermented from grains like barley, as the alcoholic foundation. These beverages are then mixed with flavorings, sweeteners, and other ingredients to create a variety of pre-mixed cocktails.

- High-Strength Premixes: High-Strength Premixes play a distinctive and important role in the Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes market as it offers a unique drinking experience by providing a more concentrated and intense flavor profile. This appeals to consumers looking for a departure from standard RTDs and a more impactful taste sensation. High-Strength Premixes refer to ready-to-drink beverages with a higher alcohol by volume (ABV) compared to standard RTDs.

Distribution Channel Insights

- Supermarket & Hypermarket: Supermarkets and hypermarkets are major retail outlets that offer a wide range of consumer goods, including beverages. These stores typically have dedicated sections for alcoholic beverages, where customers can find a variety of RTDs and High-Strength Premixes.

- Liquor Specialist Store: Liquor specialist stores cater to consumers seeking a diverse and specialized range of alcoholic beverages. They may carry a variety of RTDs and High-Strength Premixes, attracting customers looking for specific brands or premium options.

- Online Retailing: Online retailing has become increasingly popular, providing accessibility to a broader consumer base. It allows for easy product discovery, online promotions, and home delivery, making it a convenient channel for purchasing RTDs and High-Strength Premixes.

- Duty-Free Stores: Duty-free stores are retail outlets located at international airports, seaports, and border crossings. These stores offer products without the imposition of certain local import duties and taxes.

- Other Distribution Channels: Other distribution channels contribute to the overall accessibility of RTDs and High-Strength Premixes. Convenience stores, for example, cater to consumers looking for quick and easy purchases, while specialty retailers may focus on unique and niche products.

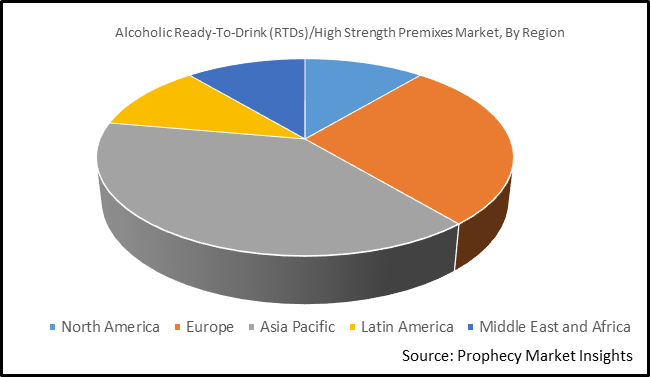

Regional Insights:

Disclaimer: This data is only a representation. Actual data may vary and will be available in the report.

North America:

- Diverse range of RTDs and High-Strength Premixes catering to evolving consumer tastes.

- Strong presence of craft and premium offerings.

- Growing interest in unique flavor profiles and innovative packaging.

Asia Pacific:

- Rapidly growing market with a rising middle class.

- High demand for convenient and on-the-go beverage options.

- Growing popularity of imported and local RTD brands.

- E-commerce playing a significant role in product accessibility.

Europe:

- Established market with a rich tradition of alcoholic beverages.

- Increasing demand for premium and craft RTDs.

- Emphasis on sustainable and eco-friendly packaging.

- Online retail and specialty liquor stores prominent in distribution.

Latin America:

- Strong cultural influence on beverage preferences.

- Growing interest in premium and flavored RTDs.

- Online retail gaining traction for convenience.

Middle East & Africa:

- Varied regulatory landscapes impacting market entry.

- Growing interest in diverse flavor options.

- Duty-free stores significant in international travel retail.

Report Scope:

|

Attribute |

Details |

|

Market Size 2024 |

US$ 35.6 billion |

|

Projected Market Size 2034 |

US$ 54.2 billion |

|

CAGR Growth Rate |

4.3% |

|

Base year for estimation |

2023 |

|

Forecast period |

2024 – 2034 |

|

Market representation |

Revenue in USD Billion & CAGR from 2024 to 2034 |

|

Market Segmentation |

By Product Type - Spirit-based RTDs, Wine-based RTDs, Malt-based RTDs, and High-Strength Premixes By Distribution Channel - Supermarket & Hypermarket, Liquor Specialist Store, Online Retailing, Duty-Free Stores, and Other Distribution Channels |

|

Regional scope |

North America - U.S., Canada Europe - UK, Germany, Spain, France, Italy, Russia, Rest of Europe Asia Pacific - Japan, India, China, South Korea, Australia, Rest of Asia-Pacific Latin America - Brazil, Mexico, Argentina, Rest of Latin America Middle East & Africa - South Africa, Saudi Arabia, UAE, Rest of Middle East & Africa |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors, and trends |

Segments Covered in the Report:

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2022 to 2032. For the purpose of this study, has segmented the Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market report based on Type, Application and region:

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, By Product Type:

- Spirit-based RTDs

- Wine-based RTDs

- Malt-based RTDs

- High-Strength Premixes

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, By Distribution Channel:

- Supermarket & Hypermarket

- Liquor Specialist Store

- Online Retailing

- Duty-Free Stores

- Other Distribution Channels

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, By Region:

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Russia

- Italy

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

Company Profile:

- Boston Beer Company *

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Brown-Forman

- Bacardi Limited

- Diageo Inc.

- Anheuser-Busch InBev

- Halewood International Ltd.

- Takara Holdings Inc.

- Edrington Group

- Campari Group

- Molson Coors Beverage Company

“*” marked represents similar segmentation in other categories in the respective section

Global Alcoholic ReadyToDrink RTDsHigh Strength Key Players

The key players operating the Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market includes, Boston Beer Company, Brown-Forman, Bacardi Limited, Diageo Inc., Anheuser-Busch InBev, Halewood International Ltd., Takara Holdings Inc., Edrington Group, Campari Group, Molson Coors Beverage Company.

Global Alcoholic ReadyToDrink RTDsHigh Strength Table of Contents

Research Objective and Assumption

- Preface

- Research Objectives

- Study Scope

- Years Considered for the study

- Assumptions

- Abbreviations

Research Methodology

- Research data

- Primary Data

- Primary Interviews

- Primary Breakdown

- Key data from Primary Sources

- Key Thickness Insights

- Secondary Data

- Major Secondary Sources

- Secondary Sources

- Market Estimation

- Top-Down Approach

- Approach for estimating Market Share by Top-Down Analysis (Supply Side)

- Bottom-Up Approach

- Approach for estimating market share by Bottom-up Analysis (Demand Side)

- Market Breakdown and Data Triangulation

- Research Assumptions

Market Preview

- Executive Summary

- Key Findings—Global Outlook for medical carts Strategies

- Key Questions this Study will Answer

- Market Snippet, By Product Type

- Market Snippet, By Distribution Channel

- Market Snippet, By Region

- Opportunity Map Analysis

- Executive Summary—3 Big Predictions

Market Dynamics, Regulations, and Trends Analysis

- Market Dynamics

- Drivers

- Restrains

- Market Opportunities

- Market Trends

- DR Impact Analysis

- PEST Analysis

- Porter’s Five Forces Analysis

- Opportunity Orbit

- Market Investment Feasibility Index

- Macroeconomic Factor Analysis

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, By Product Type, Forecast Period up to 10 Years, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), Forecast Period up to 10 Years

- Y-o-Y Growth Analysis (%), Forecast Period up to 10 Years

- Segment Trends

- Spirit-based RTDs

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Wine-based RTDs

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Malt-based RTDs

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- High-Strength Premixes

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, By Distribution Channel, Forecast Period up to 10 Years, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), Forecast Period up to 10 Years

- Y-o-Y Growth Analysis (%), Forecast Period up to 10 Years

- Segment Trends

- Supermarket & Hypermarket

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Liquor Specialist Store

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Online Retailing

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Duty-Free Stores

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

- Other Distribution Channels

- Overview

- Market Size and Forecast (US$ Bn), and Y-o-Y Growth (%), Forecast Period up to 10 Years

Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, By Region, Forecast Period up to 10 Years, (US$ Bn)

- Overview

- Market Value and Forecast (US$ Bn), and Share Analysis (%), Forecast Period up to 10 Years

- Y-o-Y Growth Analysis (%), Forecast Period up to 10 Years

- Regional Trends

- North America

- Market Size and Forecast (US$ Bn), By Product Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Distribution Channel, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- U.S.

- Canada

- Europe

- Market Size and Forecast (US$ Bn), By Product Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Distribution Channel, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- UK

- France

- Germany

- Russia

- Italy

- Rest of Europe

- Asia Pacific

- Market Size and Forecast (US$ Bn), By Product Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Distribution Channel, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- India

- Japan

- South Korea

- China

- Rest of Asia Pacific

- Latin America

- Market Size and Forecast (US$ Bn), By Product Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Distribution Channel, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- Market Size and Forecast (US$ Bn), By Product Type, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Distribution Channel, Forecast Period up to 10 Years

- Market Size and Forecast (US$ Bn), By Country, Forecast Period up to 10 Years

- GCC

- Israel

- South Africa

- Rest of Middle East

Competitive Landscape

- Heat Map Analysis

- Market Presence and Specificity Analysis

Company Profiles

- Boston Beer Company,

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Brown-Forman,

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Bacardi Limited,

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Diageo Inc.,

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Anheuser-Busch InBev,

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Halewood International Ltd.,

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

- Takara Holdings Inc.

- Company Overview

- Product Portfolio

- Key Highlights

- Financial Performance

- Business Strategies

The Last Word

- Future Impact

- About Us

- Contact

FAQs

The alcoholic ready-to-drink (RTDs)/High strength premixes market report segmented into type, distribution channel, and region.

Factors driving market growth include the changing consumer preferences for convenient and innovative alcoholic beverages, the rise of cocktail culture, and the expansion of the ready-to-drink market segment.

Global restraints may involve regulatory challenges, competition from other alcoholic beverages, and health concerns related to excessive alcohol consumption.

The report covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America is estimated to dominate the Alcoholic Ready-To-Drink (RTDs)/High Strength Premixes Market, displaying a significantly high revenue share over the forecast period.

Key players in the global alcoholic ready-to-drink (RTDs)/High strength premixes market include, Boston Beer Company, Brown-Forman, Bacardi Limited, Diageo Inc., Anheuser-Busch InBev, Halewood International Ltd., and Takara Holdings Inc.